Dear Users of OffPeak Gates,

PierPass Inc. issued the following press release this morning:

PierPass Briefs Washington Regulators and Shipper Associations

LONG BEACH, Calif., November 23, 2015—PierPass Inc. and marine terminal operator leaders conducted a series of meetings in Washington, DC last week with the Federal Maritime Commission chairman, commissioners and staff. The meetings reviewed how conditions at the marine terminals in the Ports of Los Angeles and Long Beach have rebounded strongly since the congestion crisis a year ago.

The 13 container terminals continue to provide extensive availability of service to cargo owners moving their containers through the two adjacent ports. The terminals provided an average of 82 hours per week of truck gates in August, 84 hours per week in September, and 82 hours per week in October.

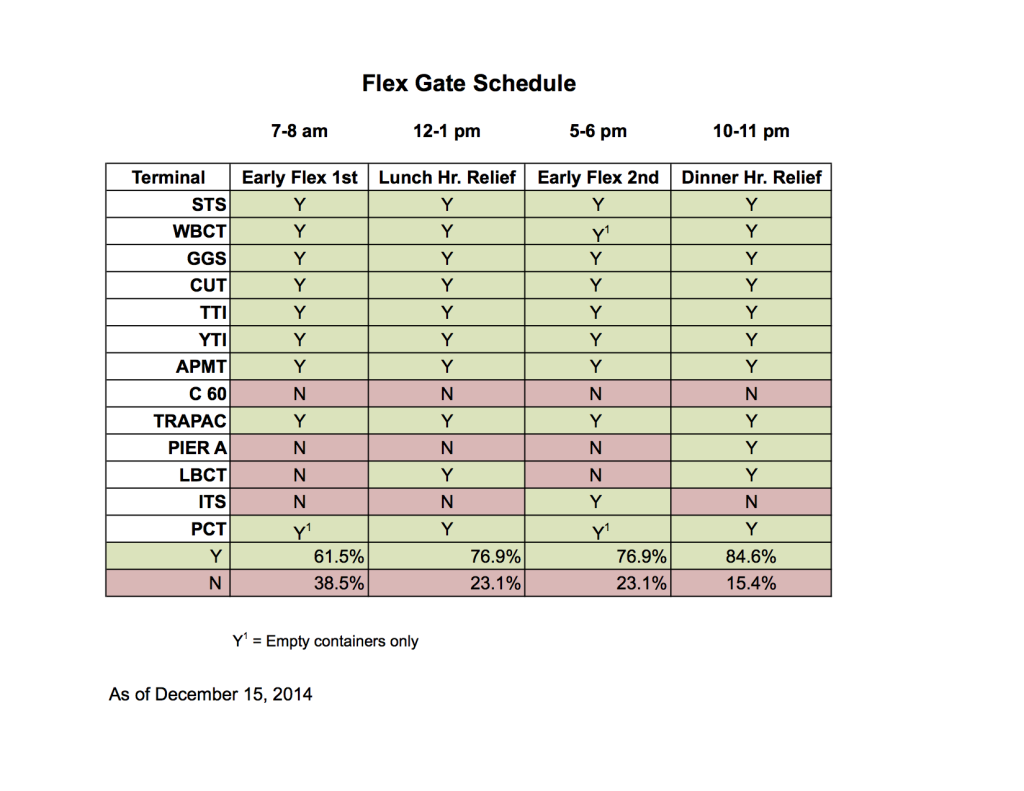

These hours of service include daytime gates Monday through Friday; four to five OffPeak gates on nights and Saturdays; flex gates, where terminals hire extra labor to open before the start of a regular shift or remain open during contractually-mandated meal breaks; and ad-hoc gates, where terminals open up for an extra night or weekend to accommodate customer needs.

Improved Cargo Velocity

The time it takes for terminals to retrieve and load import containers onto trucks or receive export containers from trucks is down sharply from its peak a year ago. Cargo is moving through the Ports of Los Angeles and Long Beach at velocities not seen since the first half of 2014, before the congestion experienced during the second half of 2014.

For trucks picking up or dropping off containers at port terminals, in-terminal turn time in October averaged 48.3 minutes on OffPeak shifts, the lowest it has been since August 2014. Daytime in-terminal turn time in October averaged 46.3 minutes, the second-lowest it has been since June 2014. That is a significant drop from late 2014 through early 2015, when daytime and OffPeak turn times exceeded 60 minutes in some months.

Washington Delegation Reviews OffPeak Costs with FMC

The delegation from PierPass and terminal operators also used the meetings with the FMC as an opportunity to review the finances of PierPass Inc. and the OffPeak program. PierPass recently published an in-depth review of the methodology it uses to calculate the cost for the terminals to operate the OffPeak gates. The review is available at http://wcmtoa.org/wp-content/uploads/2015/11/PierPass-Financial-Overview_10-21-2015.pdf. The document also reviews the methodology used to audit PierPass Inc.

Meetings with Shippers Associations

While in Washington, the delegation provided similar updates to trade associations representing cargo owners, including the Agriculture Transportation Coalition, the National Retail Federation, the Retail Industry Leaders Association and the Waterfront Coalition.

“These shipper meetings continue the extensive and ongoing outreach that the marine terminal operators and PierPass conduct with industry partners,” said PierPass Inc. President John Cushing.

Among other activities, the terminal operators and PierPass participate in the Supply Chain Optimization initiative of the two ports, working with cargo owners, trucking companies, various associations and the ports to share information and initiate programs.

About PierPass

PierPass is a not-for-profit company created by marine terminal operators at the Port of Los Angeles and Port of Long Beach to address multi-terminal issues such as congestion, air quality and security. To learn what it takes for a truck to drop off or pick up a container at a marine terminal, please see http://youtu.be/P9IJN1yIIJ4. For additional information, please see www.pierpass.org.

# # #